Expert Assistance: Bagley Risk Management Techniques

Expert Assistance: Bagley Risk Management Techniques

Blog Article

The Advantages of Livestock Threat Defense (LRP) Insurance Coverage Clarified

Animals Threat Defense (LRP) insurance works as a vital tool for animals producers navigating the unforeseeable terrain of market variations and unanticipated losses. Beyond using monetary security, this kind of insurance coverage supplies a strategic technique to risk monitoring in the farming industry. With tailored plans developed to meet the specific demands of private manufacturers and the option to take advantage of federal government subsidies, LRP insurance coverage offers a thorough option to guarding resources when faced with misfortune. However, the real worth and complexities of this insurance instrument go far past mere defense-- they symbolize a positive approach that can redefine the landscape for animals producers.

Financial Security Versus Market Volatility

LRP insurance policy gives manufacturers with a beneficial tool to take care of cost threat, providing coverage that can aid counter possible losses resulting from negative market motions. This insurance permits manufacturers to secure an ensured price for their livestock, supplying a level of certainty in an otherwise unpredictable market. By protecting versus unexpected rate declines, manufacturers can better prepare and spending plan for their procedures, eventually improving their monetary stability and resilience when faced with market uncertainties. In significance, LRP insurance coverage acts as a proactive threat management strategy that equips animals producers to navigate the difficulties of a vibrant market landscape with higher self-confidence and safety and security.

Protection for Unforeseen Losses

Livestock Danger Security (LRP) insurance policy provides detailed protection to protect animals producers versus unforeseen losses in the unpredictable market landscape. This insurance gives protection in cases where unexpected occasions such as illness episodes, natural calamities, or considerable market price fluctuations can bring about monetary hardships for animals manufacturers. By having LRP insurance coverage, producers can alleviate the risks associated with these unexpected situations and make sure a level of financial stability for their procedures.

One of the essential benefits of LRP insurance is that it allows manufacturers to customize their protection based upon their particular requirements and run the risk of resistance. This adaptability allows producers to tailor their plans to protect versus the sorts of losses that are most appropriate to their operations. Furthermore, LRP insurance policy uses an uncomplicated claims procedure, aiding manufacturers quickly recuperate from unanticipated losses and resume their operations without substantial interruptions.

Danger Monitoring for Livestock Producers

One key aspect of threat monitoring for livestock manufacturers is diversity. By expanding their animals profile, producers can spread out threat across different varieties or breeds, minimizing the effect of a potential loss in any solitary location. Furthermore, maintaining exact and in-depth records can assist producers recognize patterns, fads, and pop over to this site prospective locations of danger within their operations.

Insurance products like Livestock Risk Defense (LRP) can also play a vital function in danger administration. LRP insurance offers producers with a safety internet against unexpected price decreases, supplying them assurance and financial safety and security in times of market instability. Generally, an extensive risk monitoring method that integrates record-keeping, diversity, and insurance coverage can aid livestock producers efficiently navigate the obstacles of the sector.

Tailored Plans to Match Your Demands

Tailoring insurance plan to align with the specific demands and scenarios of livestock try these out manufacturers is critical in guaranteeing thorough danger administration approaches (Bagley Risk Management). Livestock producers face a myriad of obstacles one-of-a-kind to their industry, such as rising and fall market rates, unpredictable climate patterns, and animal wellness concerns. To resolve these dangers effectively, insurance policy companies offer tailored policies that accommodate the varied requirements of livestock manufacturers

One key facet of customized animals insurance coverage is the ability to tailor protection limits based on the dimension of the operation and the sorts of livestock being increased. This flexibility guarantees that producers are under-insured or not over-insured, allowing them to safeguard their possessions effectively without spending for unneeded protection.

Furthermore, customized policies might also include specific arrangements for various kinds of animals operations, such as milk farms, ranches, or chicken manufacturers. By tailoring insurance coverage to suit the special characteristics of each operation, insurance service providers can provide extensive protection that resolves the particular risks faced by different kinds of livestock producers. Inevitably, picking a customized insurance coverage policy can give tranquility of mind and economic safety for animals manufacturers despite unpredicted difficulties.

Government-Subsidized Insurance Options

In considering threat administration approaches tailored to the details demands of animals producers, it is important to discover the Government-subsidized insurance options offered to mitigate economic find unpredictabilities effectively. Government-subsidized insurance options play a crucial function in offering budget-friendly danger management devices for animals manufacturers (Bagley Risk Management). These programs are created to support manufacturers in protecting their procedures versus numerous dangers such as rate variations, natural catastrophes, and various other unanticipated occasions that might affect their profits. By providing aids, the government intends to make insurance much more easily accessible and cost-efficient for producers, motivating them to actively handle their dangers.

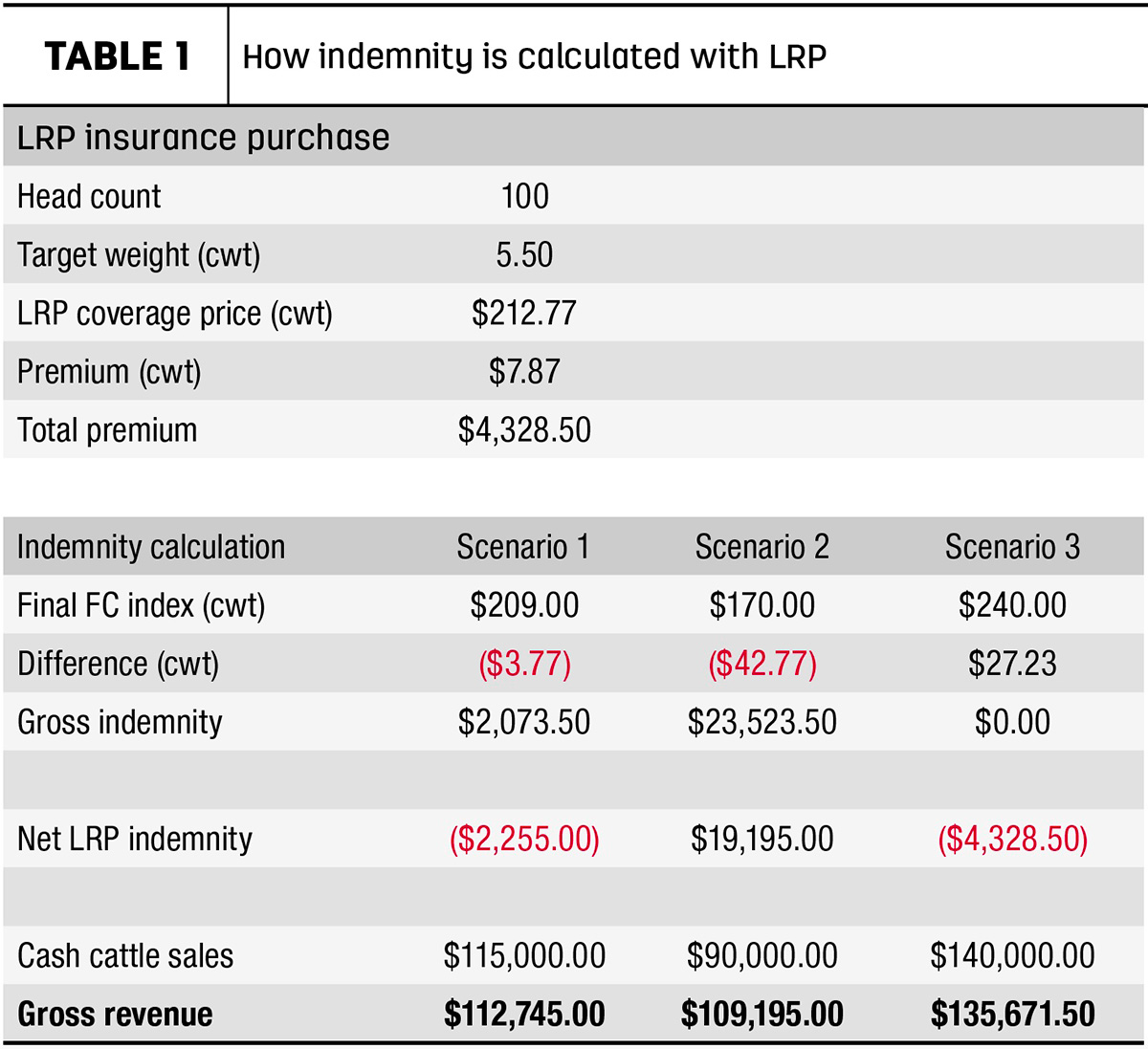

One noticeable example of a government-subsidized insurance coverage option is the Livestock Threat Defense (LRP) program, which provides security against a decline in market prices. Through LRP, producers can guarantee their animals at a details protection degree, hence ensuring a minimal price for their pets at the end of the insurance duration. By leveraging these subsidized insurance options, animals manufacturers can enhance their economic protection and security, ultimately adding to the durability of the agricultural field in its entirety.

Verdict

Finally, Livestock Risk Defense (LRP) insurance policy supplies economic security versus market volatility and unpredicted losses for livestock producers. It acts as a beneficial risk administration device, with tailored plans to fit specific requirements. Government-subsidized insurance policy options even more enhance the ease of access and price of LRP insurance for manufacturers. Take into consideration LRP insurance policy as a strategic investment to secure your livestock operation against potential dangers and uncertainties on the market.

Livestock Risk Protection (LRP) insurance coverage offers as a critical device for livestock producers navigating the uncertain surface of market changes and unanticipated losses.In today's unforeseeable market setting, animals manufacturers can profit substantially from protecting monetary defense versus market volatility via Livestock Threat Protection (LRP) insurance. In essence, LRP insurance policy offers as a proactive risk monitoring approach that equips livestock manufacturers to browse the difficulties of a dynamic market landscape with higher self-confidence and security.

Animals Danger Defense (LRP) insurance coverage uses extensive protection to protect animals manufacturers versus unexpected losses in the volatile market landscape.In verdict, Livestock Threat Protection (LRP) insurance uses monetary defense against market volatility and unforeseen losses for livestock manufacturers.

Report this page