Professional Support: Bagley Risk Management Approaches

Professional Support: Bagley Risk Management Approaches

Blog Article

Exactly How Animals Threat Defense (LRP) Insurance Coverage Can Safeguard Your Livestock Financial Investment

In the world of livestock investments, mitigating risks is paramount to guaranteeing financial security and development. Animals Danger Defense (LRP) insurance coverage stands as a trustworthy shield against the unforeseeable nature of the market, providing a calculated approach to protecting your assets. By diving right into the complexities of LRP insurance policy and its diverse advantages, livestock producers can strengthen their financial investments with a layer of safety and security that goes beyond market fluctuations. As we check out the world of LRP insurance, its duty in securing livestock investments comes to be significantly evident, promising a course towards sustainable financial resilience in an unstable market.

Recognizing Animals Threat Security (LRP) Insurance Coverage

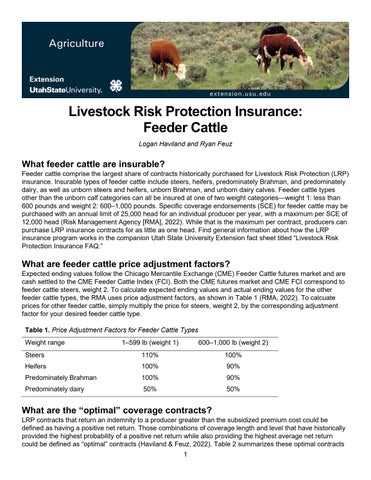

Comprehending Livestock Danger Security (LRP) Insurance is crucial for livestock manufacturers aiming to reduce monetary dangers connected with rate fluctuations. LRP is a government subsidized insurance item designed to protect manufacturers versus a decrease in market rates. By giving coverage for market cost declines, LRP helps manufacturers secure in a floor cost for their livestock, making sure a minimum degree of profits no matter of market fluctuations.

One key facet of LRP is its flexibility, allowing manufacturers to personalize protection levels and policy sizes to fit their details demands. Manufacturers can choose the variety of head, weight array, protection price, and coverage duration that line up with their production goals and run the risk of tolerance. Comprehending these adjustable choices is crucial for manufacturers to efficiently manage their rate risk direct exposure.

Moreover, LRP is available for numerous livestock types, including livestock, swine, and lamb, making it a functional threat management device for animals manufacturers across different markets. Bagley Risk Management. By familiarizing themselves with the complexities of LRP, manufacturers can make enlightened decisions to protect their financial investments and make certain financial security in the face of market uncertainties

Advantages of LRP Insurance for Animals Producers

Animals producers leveraging Animals Danger Security (LRP) Insurance get a critical benefit in shielding their financial investments from price volatility and safeguarding a secure monetary ground in the middle of market unpredictabilities. By establishing a floor on the cost of their animals, producers can minimize the risk of considerable economic losses in the occasion of market recessions.

Additionally, LRP Insurance policy supplies manufacturers with tranquility of mind. On the whole, the benefits of LRP Insurance policy for livestock producers are significant, offering a useful device for handling risk and making sure monetary protection in an unforeseeable market atmosphere.

Just How LRP Insurance Coverage Mitigates Market Threats

Alleviating market dangers, Animals Danger Defense (LRP) Insurance gives livestock producers with a reputable guard versus rate volatility and monetary unpredictabilities. By providing defense versus unexpected price decreases, LRP Insurance coverage helps manufacturers safeguard their financial investments and keep economic security despite market variations. This kind of insurance policy enables livestock manufacturers to secure a rate for their animals at the start of the plan period, guaranteeing try this out a minimal cost level no matter market changes.

Actions to Safeguard Your Animals Financial Investment With LRP

In the realm of agricultural threat monitoring, implementing Livestock Risk Security (LRP) Insurance coverage includes a calculated procedure to safeguard financial investments versus market variations and uncertainties. To protect your animals financial investment effectively with LRP, the primary step is to analyze the specific threats your procedure faces, such as rate volatility or unanticipated climate events. Comprehending these risks allows you to determine the coverage degree needed to safeguard your investment sufficiently. Next, it is essential to research and pick a reputable insurance supplier that uses LRP policies customized to your animals and business demands. Once you have actually chosen a company, carefully assess the policy terms, problems, and protection limits to guarantee they align with your threat administration objectives. Additionally, consistently keeping track of market fads and changing your insurance coverage as needed can assist optimize your security versus potential losses. By complying with these actions carefully, you can boost the safety and security of your animals investment and navigate market unpredictabilities with self-confidence.

Long-Term Financial Safety With LRP Insurance Policy

Ensuring withstanding about his economic security via the usage of Livestock Danger Security (LRP) Insurance coverage is a prudent lasting approach for farming producers. By integrating LRP Insurance into their risk management strategies, farmers can secure their animals investments versus unexpected market variations and unfavorable occasions that can endanger their monetary well-being over time.

One trick benefit of LRP Insurance policy for long-term monetary protection is the satisfaction it uses. With a dependable insurance coverage plan in position, farmers can mitigate the economic dangers linked with unstable market conditions and unanticipated losses because of factors such as condition break outs or all-natural catastrophes - Bagley Risk Management. This stability enables producers to concentrate on the day-to-day procedures of their livestock organization without continuous worry regarding potential monetary setbacks

In Addition, LRP Insurance coverage gives a structured strategy to handling threat over the lengthy term. By establishing particular coverage degrees and choosing proper endorsement durations, farmers can tailor their insurance coverage intends to line up with their economic goals and run the risk of resistance, guaranteeing a safe and lasting future for their livestock operations. In verdict, investing in LRP Insurance coverage is an aggressive strategy for agricultural manufacturers to attain enduring economic security and safeguard their resources.

Conclusion

In verdict, Animals Danger Protection (LRP) Insurance is a beneficial tool for livestock producers to mitigate market risks and safeguard their financial investments. It is a smart option for protecting livestock financial investments.

Report this page