Navigating Service Risks with Bagley Risk Management

Navigating Service Risks with Bagley Risk Management

Blog Article

Safeguard Your Animals With Livestock Risk Protection (Lrp) Insurance Policy

Livestock Threat Security (LRP) insurance coverage provides a tactical device for manufacturers to shield their investment and minimize prospective economic threats. By comprehending the ins and outs of LRP insurance coverage, manufacturers can make enlightened decisions that safeguard their source of incomes.

Recognizing Livestock Risk Protection (LRP) Insurance

Animals Threat Security (LRP) Insurance policy provides necessary coverage for animals manufacturers against possible financial losses due to market value fluctuations. This kind of insurance coverage allows manufacturers to reduce the risk linked with unforeseeable market conditions, making sure a level of monetary security for their operations. By utilizing LRP Insurance coverage, manufacturers can lock in a minimal cost for their animals, securing against a decrease in market value that might negatively influence their profits.

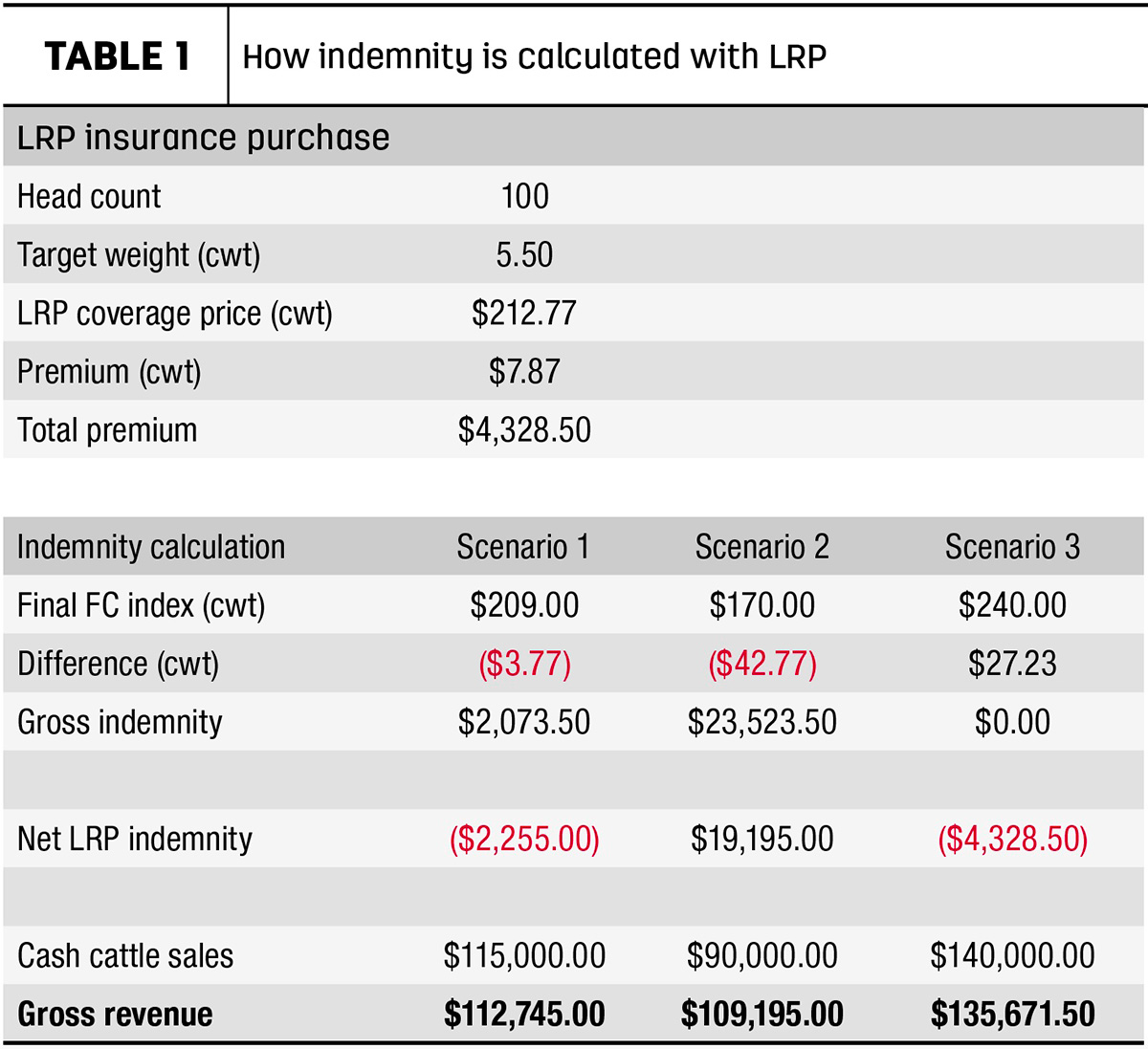

LRP Insurance policy operates by providing protection for the difference between the real market and the insured cost price at the end of the coverage duration. Manufacturers can select coverage levels and coverage durations that line up with their specific needs and risk resistance. This versatility enables manufacturers to customize their insurance to ideal secure their monetary rate of interests, supplying assurance in an inherently unpredictable market.

Recognizing the complexities of LRP Insurance is crucial for animals producers looking to safeguard their operations against market unpredictabilities. By leveraging this insurance device properly, manufacturers can navigate market variations with confidence, ensuring the lasting stability of their livestock businesses.

Benefits of LRP Insurance Policy for Animals Producers

Enhancing financial safety and stability, Animals Risk Security (LRP) Insurance coverage offers beneficial safeguards versus market rate variations for producers in the animals sector. Among the essential benefits of LRP Insurance policy is that it provides manufacturers with a device to take care of the threat related to unforeseeable market value. By allowing producers to establish an ensured price flooring for their livestock, LRP Insurance coverage aids shield against prospective losses if market value fall below a certain degree.

Additionally, LRP Insurance coverage allows manufacturers to make even more informed decisions regarding their operations. With the assurance of a minimum rate for their animals, manufacturers can plan ahead with greater confidence, knowing that they have a safeguard in place. This can result in increased security in revenue and reduced financial anxiety throughout times of market volatility.

Just How LRP Insurance Policy Mitigates Financial Dangers

By giving manufacturers with a reputable safeguard against market cost changes, Livestock Risk Protection (LRP) Insurance policy successfully safeguards their financial security and decreases possible risks. One key means LRP insurance policy helps reduce monetary risks is by offering defense against unforeseen declines in animals rates. Producers can acquire LRP plans for certain weight series of livestock, enabling them to hedge versus market declines that might otherwise cause substantial economic losses.

Moreover, LRP insurance gives manufacturers with comfort, understanding Check Out Your URL that they have an established level of rate protection. This certainty permits manufacturers to make informed choices regarding their procedures without being unduly influenced by uncertain market changes. Additionally, by reducing the monetary uncertainty associated with price volatility, LRP insurance policy allows producers to far better prepare for the future, assign sources effectively, and ultimately improve their general monetary resilience.

Actions to Safeguard LRP Insurance Coverage

Safeguarding LRP insurance policy protection includes a series of uncomplicated steps that can give producers with valuable protection against market unpredictabilities. The initial step in obtaining LRP insurance policy is to call an accredited crop insurance agent. These agents are well-informed about the program and can direct manufacturers via the application procedure. Producers will require to provide basic info regarding their livestock operation, such as the sort of animals being insured, the variety of head, and the coverage period wanted.

When the application is submitted, manufacturers will require to pay a costs based on the protection degree and variety of head insured. It is important to examine and recognize the plan extensively before making any kind of repayments to ensure it meets the certain demands of the procedure. Bagley Risk Management. After the premium is paid, producers will certainly receive a certification of insurance, recording their protection

Throughout the protection period, producers must maintain comprehensive records of their livestock stock and market value. In the event of a rate decline, producers can sue with their insurance policy agent to obtain payment for the difference between the insured rate and the marketplace cost. By following these steps, manufacturers can secure their animals procedure versus monetary read losses created by market changes.

Taking Full Advantage Of Value From LRP Insurance Policy

To draw out the full gain from Livestock Risk Protection Insurance coverage, producers need to tactically make use of the coverage choices offered to them. Making best use of the worth from LRP insurance entails a detailed understanding of the policy attributes and making educated decisions. One crucial strategy is to our website thoroughly analyze the protection levels and period that best align with the details requirements and dangers of the animals operation. Producers need to also on a regular basis review and change their insurance coverage as market conditions and danger factors develop.

Furthermore, producers can improve the value of LRP insurance coverage by leveraging corresponding danger administration devices such as futures and alternatives contracts. By branching out danger monitoring strategies, producers can reduce prospective losses extra effectively. It is essential to stay informed about market trends, government programs, and market advancements that might influence animals costs and take the chance of monitoring methods.

Ultimately, maximizing the worth from LRP insurance policy calls for positive preparation, recurring tracking, and flexibility to altering scenarios. By taking a calculated approach to take the chance of administration, manufacturers can safeguard their animals operations and boost their overall economic security.

Final Thought

In verdict, Animals Danger Security (LRP) Insurance policy offers useful advantages to livestock manufacturers by mitigating financial dangers connected with variations in market value. Bagley Risk Management. By securing LRP insurance protection, manufacturers can safeguard their livestock financial investments and potentially enhance their success. Understanding the benefits and actions to optimize worth from LRP insurance policy is vital for animals manufacturers to successfully take care of threats and protect their companies

Livestock Risk Protection (LRP) Insurance gives important protection for livestock producers against potential monetary losses due to market rate variations.Enhancing monetary protection and security, Animals Danger Security (LRP) Insurance coverage uses important safeguards against market price changes for producers in the animals market.By supplying producers with a trustworthy safety and security web against market price variations, Animals Risk Defense (LRP) Insurance policy properly safeguards their financial stability and lessens potential threats. The initial action in acquiring LRP insurance is to contact a licensed plant insurance policy agent.In conclusion, Animals Threat Protection (LRP) Insurance uses important benefits to animals producers by mitigating monetary threats linked with fluctuations in market costs.

Report this page